Alex Gudilko, CEO of AJProTech - Product Development Studio in Los Angeles, California.

The phrase “everything is made in China” has become a familiar refrain across the global hardware industry. In light of the pandemic and trade wars of the past few years, businesses have had to grapple with the challenge of finding new ways to manufacture electronics without relying on China. In this article, we will explore the components that are typically sourced from China and provide strategies for businesses to reduce their dependence on Chinese imports without significantly increasing device costs. Gold Wire Bonding

The U.S. tech industry has not fully recovered from the pandemic crisis when another problem hit: trade wars. In 2022, manufacturers faced the most challenging period, with lead times of approximately 52 weeks for many semiconductors, compared to approximately 16 weeks prior to 2020. Reducing dependency on Chinese manufacturing has become a priority for everyone, creating additional limitations for manufacturers and distributors.

Let’s identify where and what type of semiconductors are produced—and which of them can be transferred out of China.

The hardware industry has seen remarkable growth over the last decades, thanks to the specialization of Asian countries in their respective fields of expertise. Japan specializes in the production of high-tech electronics, Taiwan produces chips and semiconductors, South Korea is a leading manufacturer of display optics and continental China focused on component manufacturing components and final assembly. This specialization enabled the industry to lower costs and make technology available and accessible to all. Today, China is one of the top five largest producers of semiconductors, alongside Taiwan, South Korea, the U.S. and Japan.

When it comes to protecting oneself from geopolitical risks today, there are certain measures to consider:

The vast majority of complex chips that are distributed globally are largely produced in Taiwan, while Chinese manufacturers usually produce simple components for the mass market. There is also an impressive amount of microchips mainly produced for the Chinese domestic market to meet growing demand.

China is the top producer of large components such as batteries, speakers, and power supplies. Thanks to its established production infrastructure, the products manufactured in China are cost-effective and of dependable quality. Although other countries can manufacture these components, they typically come at a 30-50% higher cost, based on my experience in the industry.

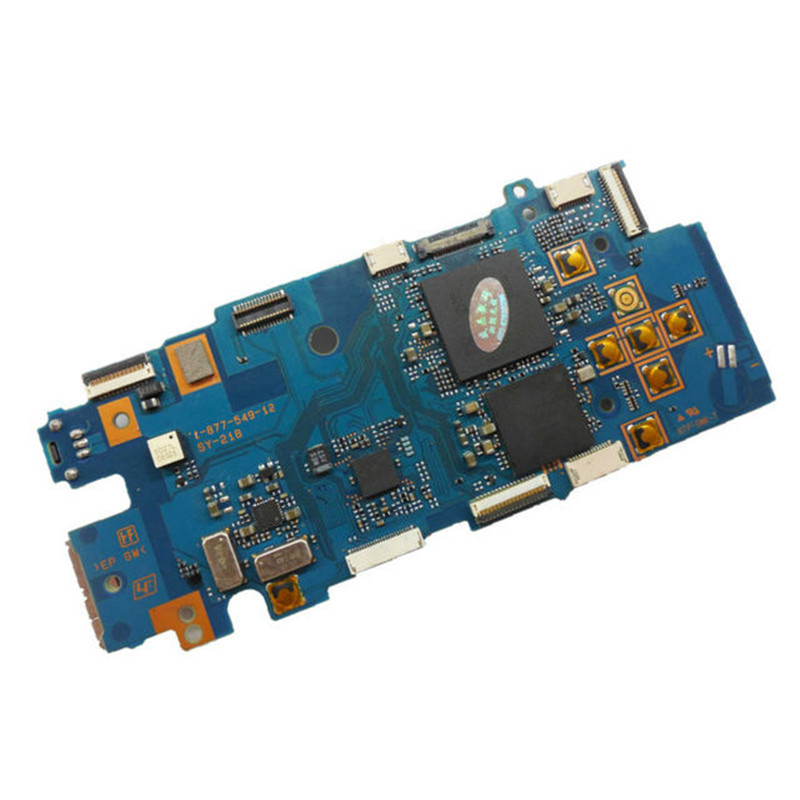

Every electronics product has one or more printed circuit boards (PCBs) inside. Chinese PCB manufacturers have mastered PCB production and assembly at low cost and high quality. An increasing number of Southeast Asian countries are growing their capacity to produce general-purpose PCBs at comparable costs. However, it is important to note that PCBA assembly is only a part of the process; the supply chain for many electronic components installed on the boards still relies heavily on Chinese manufacturers. The key takeaway here is that PCB production may be done elsewhere at little extra cost, with the exception of high-tech PCBs like those found in iPhones.

China remains the absolute leader in the assembly of final products. Established assembly lines and an abundance of skilled workers allow for high production volumes at reasonable costs. When many businesses claim that their products are "not made in China," it often implies that the final assembly was done elsewhere. Some products are assembled in India, Vietnam, Indonesia or even Mexico. This is a viable marketing strategy and a good first step to diversifying production. However, we need to keep it real—assembly is usually less than 20% of the device cost, from what I've seen, and if 90% of components still come from one country, production is still heavily dependent on it.

To identify which electronics to produce domestically and which to keep in China, let's evaluate the types of electronics and consider their cost-benefit analyses:

Audio devices, wearables and inexpensive smartphones produced at high volume follow the golden rule: The bill of materials cost should not exceed 20-25% of the retail price to cover marketing, logistics, and operations expenses. It is difficult to move production of these products outside of China while still maintaining the same cost. If you consider other countries, you should expect to pay a premium. Some of the cost differences may be offset by reduced import tariffs when manufactured in “friendly countries.”

Premium high-tech electronics, such as video cards, computer memory and other advanced devices, often boast high-profit margins due to high entry barriers, limited competition and intellectual property protection. These products are typically manufactured in Taiwan, Japan and sometimes the U.S. or Europe. Speed of innovation, quality and IP protection are key considerations when choosing these production locations. Taiwan and Japan offer unparalleled capabilities for mass-producing complex electronics.

Most medical equipment requires compliance and certifications in the U.S. to meet FDA requirements for product design and manufacturing process. Many companies opt to manufacture medical products domestically due to the ease of meeting and keeping compliance and the ability to maintain closer control over production. Bill of materials costs are less of a factor given the higher margins of most medical products, with legal, marketing and liability expenses playing a larger role in decision-making.

Most nations prioritize national security. Consequently, components for aerospace and military products are predominantly fabricated within their own borders. Manufacturers that provide parts for the defense industry are required to create critical parts independently from general-use items. Winning and maintaining government contracts is a long-term tactic for several domestic US manufacturers. In 2023, defense tech got a lot of attention. The extra capital attracts additional talent and more production capacity.

I remain cautiously optimistic about the current state of the supply chain in 2023. We see improvement in lead times and anticipate that the supply chain for most components may return to normal by quarter two of 2024. We hope that the ongoing trade tensions will be resolved amicably and with a mutual understanding of the benefits of globalization for the collective good of humanity.

Forbes Technology Council is an invitation-only community for world-class CIOs, CTOs and technology executives. Do I qualify?

I am a staff writer on the vices beat, covering cannabis, gambling and more. I believe in the many virtues of vices. Previously at Forbes, I covered the world’s richest people as a member of the wealth team. I have been a staff writer at Inc. magazine where I wrote about entrepreneurs doing business in the legal fringes of society. Before that, I reported stories that took me to the West Bank, Moscow and Brooklyn.

I am a staff writer on the vices beat, covering cannabis, gambling and more. I believe in the many virtues of vices. Previously at Forbes, I covered the world’s richest people as a member of the wealth team. I have been a staff writer at Inc. magazine where I wrote about entrepreneurs doing business in the legal fringes of society. Before that, I reported stories that took me to the West Bank, Moscow and Brooklyn.

Harikishore Sreenivasalu is the founder and CTO of Aarini Consulting. Read Harikishore Sreenivasalu's full executive profile here.

Jack Hidary is the CEO of SandboxAQ. Read Jack Hidary's full executive profile here.

Pcba Control Board Factory Demaris Mills is president at Integrated DNA Technologies, a global genomics solutions provider. Read Demaris Mills' full executive profile here.